san antonio local sales tax rate 2019

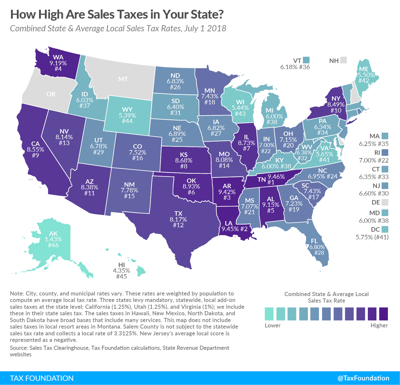

211 South Flores Street San Antonio TX 78207 Phone. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent.

Understanding California S Sales Tax

Published on September 20 2019 by Youngers Creek.

. Nineteen major cities now have combined rates of 9 percent or higher. Maintenance Operations MO and Debt Service. 78201 78202 78203.

Ad Lookup Sales Tax Rates For Free. San Antonios current sales tax rate is 8250 and is distributed as follows. You can print a 7 sales tax table here.

There is no applicable city tax or special tax. 127 rows Sixteen cities with populations of 200000 or more do not impose local sales taxes though some have state sales taxes as high as 7 percent Fort Wayne and Indianapolis Indiana. TX Sales Tax Rate.

San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. The San Antonio sales tax rate is.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The five states with the highest average combined state and local sales tax rates are Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent Washington 917 percent and. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage.

The 2018 United States Supreme Court decision in South Dakota v. Sales Tax Rate Changes in Major Cities. The December 2020 total local sales tax rate was also 8250.

The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows.

If you have questions about Local Sales and Use Tax rates or boundary information. 12 San Antonio ATD. San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250.

1000 City of San Antonio. Lower sales tax than 87 of Florida localities 05 lower than the maximum sales tax in FL The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. Local Code Rate Effective Date.

Texas Comptroller of Public Accounts. San Antonio is in the following zip codes. The median rate for major cities is 8 percent.

Rates will vary and will be posted upon arrival. Bexar Co Es Dis No 12. Wayfair Inc affect Texas.

The San Antonio Texas general sales tax rate is 625. 0500 San Antonio MTA Metropolitan Transit Authority. Published on September 20 2019 by Youngers Creek.

Combined Area Name Local Code Rate. Sales Tax Breakdown San Antonio Details San Antonio TX is in Bexar County. San Antonio Local Sales Tax Rate.

Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services. The Texas sales tax rate is currently. Sales and Use Tax.

The San Antonio Texas general sales tax rate is 625. City sales and use tax codes and rates. Did South Dakota v.

The County sales tax rate is. Interactive Tax Map Unlimited Use. Tennessee Now Has The Highest Sales Tax In The Country Pith In The Wind Nashvillescene Com.

Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05. The portion of the sales tax rate collected by San Antonio is 125 percent. The current total local sales tax rate in San Antonio TX is 8250.

Local Code Local Rate Total Rate. There is no applicable county tax. Has impacted many state nexus laws and sales tax collection requirements.

The property tax rate for the City of San Antonio consists of two components. The current total local sales tax rate in San Antonio TX is 8250. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05.

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Understanding California S Sales Tax

Understanding California S Sales Tax

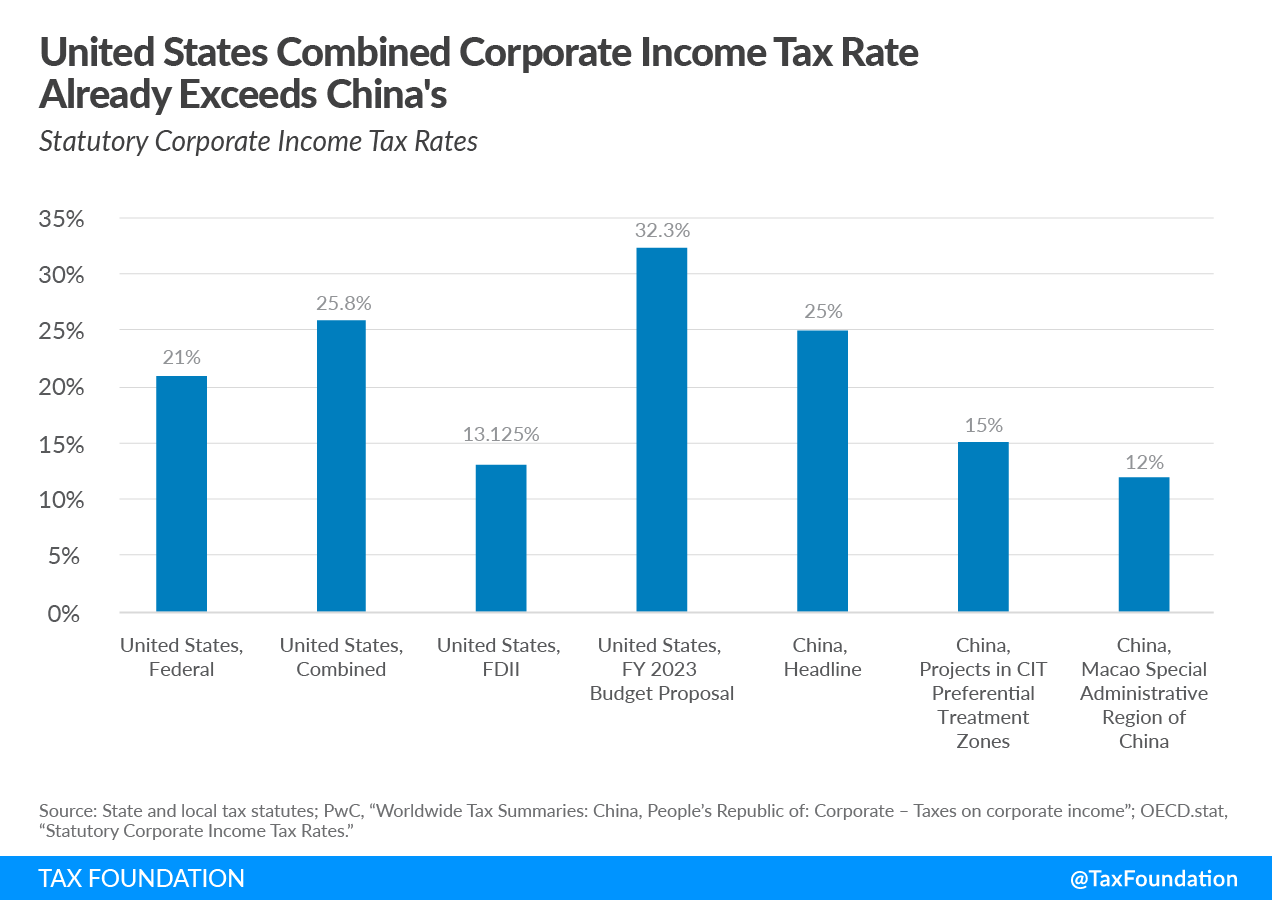

Joe Biden Tax Plans Proposals Tax Foundation

What Is The Austin Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Tennessee Now Has The Highest Sales Tax In The Country Pith In The Wind Nashvillescene Com

Understanding California S Sales Tax

Tax Proposals Comparisons And The Economy Tax Foundation

Texas Sales Tax Guide For Businesses

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Understanding California S Sales Tax

Which Texas Mega City Has Adopted The Highest Property Tax Rate